UPDATE:

On May 13, 2025, Governor Phil Scott issued Executive Order 04-25 directing the Agency of Natural Resources to pause enforcement of rules that require vehicle and engine manufacturers to deliver battery electric and plug-in hybrid vehicles to Vermont. To be eligible for this paused enforcement, manufacturers must not impose zero-emission vehicle sales “ratios”. These ratios negatively impact dealers in Vermont by requiring them to sell zero-emission vehicles before allowing the sale of internal combustion engine cars and trucks. This “ratioing” practice limits the number and type of vehicles available to Vermont dealerships and customers. The rules affected are Advanced Clean Cars II (ACCII), Advanced Clean Trucks (ACT), and Heavy-Duty Engine and Vehicle Omnibus (HD Omnibus).

Who does the Executive Order apply to?

This Executive Order pauses enforcement of the rules for vehicle and engine manufacturers who do not require zero-emission vehicle sales before allowing internal combustion engine cars and truck sales (“ratioing”). However, manufacturers that practice ratioing must still follow the rules.

What does the Executive Order mean?

For Model Year 2026, manufacturers do not need to meet the zero-emission vehicle sales requirements in the ACCII or ACT rules or the obligations of the HD Omnibus rule if they do not limit the delivery and sale of vehicles to Vermont dealerships.

Manufacturers must submit a report to the Agency detailing their efforts to:

- promote and market zero-emission vehicles;

- increase deployment of charging infrastructure;

- educate and train dealers including sales and service staff on zero-emissions vehicles; and,

- provide zero-emissions vehicles for ride and drive events.

Complaints

Any complaints from dealers, municipalities, or fleets about manufacturers limiting the delivery and sale of gasoline and diesel vehicles to Vermont dealerships can be emailed to the Agency of Natural Resources (ANR) at ANR.DEClevzev@vermont.gov or submitted anonymously by completing this Microsoft Form. Complaints should include the following information:

- Vehicle Make

- Vehicle Model

- Vehicle Model Year

- Number of Vehicles

- Dealership

- Explanation of complaint

All complaints will be evaluated by ANR to determine if a manufacturer remains eligible for the compliance relief provided by the Executive Order.

Guidance for Vehicle and Engine Manufacturers

More information coming soon.

In December of 2022, Vermont adopted the Advanced Clean Trucks (ACT) rule, which incorporates California motor vehicle emissions standards. The rule is intended to accelerate the transition to zero-emission medium- and heavy-duty vehicles by requiring manufacturers to gradually increase deliveries of new zero-emission vehicles for sale in Vermont. The ACT rule helps protect public health and air quality and will give Vermonters increased choice to integrate electric vehicle and hybrid technologies into their fleets. Accelerating the zero-emission truck and bus market also supports Vermont’s greenhouse gas emissions reduction goals in both the Comprehensive Energy Plan and Initial Climate Action Plan. For more information on the regulation, see the Regulation Summary and adopted rule language, Chapter 40.

Myth vs. Fact

To help address the misinformation circulating about the ACT rule, please see our fact sheet, Myth vs. Fact. For example, claiming the regulation requires a ZEV model be sold before selling an internal combustion engine vehicle – that’s a myth!

Frequently Asked Questions

For answers to common questions about the ACT rule, please see Advanced Clean Trucks Regulation Frequently Asked Questions prepared by NESCAUM (Northeast States for Coordinated Air Use Management).

Truck Availability

For more information on the impact of the ACT rule on truck availability, please see California Air Resources Board (CARB) Truck Availability Analysis Memo.

Listing of Certified Medium- and Heavy-duty ZEVs

For a list of medium- and heavy-duty zero-emission vehicles (ZEVs) certified for sale for the 2022, 2023, and 2024 model years, please see this table. This list can assist fleet owners in identifying ZEVs in the market.

Truck Pricing

In this fact sheet, CARB explores the differences between zero-emission truck pricing in the European Union (EU) and the United States (US) and the reasons for it.

VT is Not Alone | ACT Overview | Compliance Flexibilities | Charging | Funding

Vermont is Not Alone

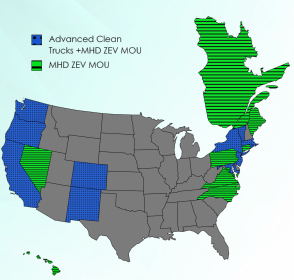

Vermont is joined by 10 other states in adopting heavy-duty vehicle requirements. California, Colorado, Maryland, Massachusetts, New Jersey, New Mexico, New York, Oregon, Rhode Island, Vermont and Washington have all adopted some level of California heavy-duty vehicle requirements. Together, these states represent approximately 26% of the national market share of heavy-duty vehicles.

The deployment of ZEVs also supports meeting goals identified in the 2020 Multi-State Medium- and Heavy-Duty Zero Emission Vehicle Memorandum of Understanding (MOU) of accelerating a transition to zero-emission trucks and buses. This multi-state MOU is part of a significant regional effort that Vermont has joined with 16 other states, D.C. and the province of Quebec. As a result of the MOU, a multi-state comprehensive Action Plan containing more than 65 policy recommendations to support rapid electrification of the medium- and heavy-duty sectors was released. In development of the Action Plan, input from a wide variety of stakeholders including environmental justice and community-based organizations, truck and bus manufacturers, industry and technology experts, charging and fueling providers, utility companies, public and private sector fleet representatives, commercial financing experts, and environmental advocates was provided.

What is the Advanced Clean Trucks (ACT) Rule?

The ACT rule applies to manufacturers, not dealers, of medium- and heavy-duty on-road vehicles over 8,500 pounds gross vehicle weight rating (GVWR) which includes passenger vans, larger pickups, buses, vocational trucks, box trucks, and tractor trailer combinations used locally and for long-haul on-road applications. Off-road vehicles and equipment are not part of the ACT rule. Light-duty trucks (e.g., the Ford F-150, Chevrolet Silverado 1500, Ram 1500 and Toyota Tacoma) are covered under the Advanced Clean Cars II rule, not the ACT rule.

The ACT rule does not require a dealer to sell an electric truck before a diesel truck may be sold. Nor does it require a fleet to purchase an electric truck before being allowed to purchase a diesel truck.

To reduce greenhouse gases (GHGs) and other harmful vehicle emissions, the ACT rule sets a sales requirement for manufacturers to sell zero-emission trucks as an increasing percentage of their annual Vermont sales from 2026 to 2035. Manufacturers gain credits for selling ZEVs or NZEVs (near zero emission vehicles, such as plug-in hybrids) in Vermont, based on vehicle model year and vehicle weight class, pursuant to a schedule that gradually increases over time:

| Model Year | Class 2b-3 |

Class 4-8 Straight Trucks |

Class 7-8 Tractors |

|---|---|---|---|

| 2026 | 10% | 13% | 10% |

| 2027 | 15% | 20% | 15% |

| 2028 | 20% | 30% | 20% |

| 2029 | 25% | 40% | 25% |

| 2030 | 30% | 50% | 30% |

| 2031 | 35% | 55% | 35% |

| 2032 | 40% | 60% | 40% |

| 2033 | 45% | 65% | 40% |

| 2034 | 50% | 70% | 40% |

| 2035+ | 55% | 75% | 40% |

Class 2b-3: 8,501-14,000 lbs., Class 4-8: 14,001+ lbs., Class 7-8 Tractors: 26,001+ lbs.

Under the ACT rule, new diesel heavy-duty trucks will continue to be available for sale in Vermont while providing an increased choice for fleets when making decisions about what vehicle will best suit their needs.

How can Vehicle Manufacturers Comply with ACT? Are There Compliance Flexibilities?

The ACT rule includes flexibility for manufacturers to produce and sell new ZEVs into the market segments they deem to be most suitable for the products they manufacture, ensuring that manufacturers develop competitive ZEV products at price points that will meet fleet needs.

The ACT rule uses a credit/deficit system to determine compliance, which includes flexibilities (below) that can be used by manufacturers. A manufacturer generates deficits by selling diesel trucks in Vermont, while a manufacturer generates credits by selling ZEVs or NZEVs (near zero emission vehicles, such as plug-in hybrids) in Vermont. Class 2b-3, Class 4-5, Class 6-7, and Class 8 non-tractor credits may be used interchangeably to make up non-tractor deficits. Generally, Class 7-8 tractor deficits can only be made up with Class 7-8 tractor credits; however, if only a small number of Class 7-8 tractor deficits are generated in a model year (as will likely be the case in Vermont) these deficits can be made up with any credits.

- Banking and Trading Credits. Manufacturers may earn and bank credits as well as trade credits between manufacturers. Credits that are banked can be used in future model years.

- Early Action Credits. Manufacturers may earn “early action” credits for eligible 2023 to 2025 model year ZEVs and NZEVs sold in Vermont prior to the regulatory requirements going into effect in model year 2026. These credits may be banked or traded.

- Interchangeable Credits. The current credit and deficit system uses “weight class modifiers,” which allow for heavier vehicles that produce more emissions to generate more deficits and, as ZEVs, generate more credits. A manufacturer has the option of using credits from a weight class to make up deficits in other weight classes or choose to build ZEVs in one weight class or across all weight classes. These are business decisions made by the manufacturers, but the ACT rule is designed to provide manufacturers with options to comply with the requirements.

- Low Tractor Volume Flexibility. A manufacturer who generates 25 or fewer Class 7-8 tractor deficits in a model year and has tractor deficits remaining after retiring applicable credits can use up to 25 ZEV credits from any weight class group to satisfy their Class 7-8 tractor group deficits.

- Deficit Make Up Period. A manufacturer that has fewer ZEV or NZEV credits than required to meet its obligation in a given model year must make up the deficit by the end of the next model year. CARB has initiated a rulemaking to lengthen the number of years a manufacturer has to make up a deficit from one year to three years.

- Pooling. CARB plans to initiate a rulemaking in calendar year 2025 to allow pooling under the ACT regulation. Pooling is a compliance flexibility that allows manufacturers to transfer excess credits earned in one state to satisfy deficits generated in another state. In effect, pooling allows manufacturers to use credits earned in one state to comply with ZEV sales requirements in another state.

The ACT rule allows manufacturers the flexibility to focus on the vehicle weight classes and models that are currently best suited for electrification. As technology continues to advance, it is anticipated that ZEVs will be deployed in a wider range of applications.

What About Charging Infrastructure Readiness?

In the near term, it is expected that most charging infrastructure deployed to support electric trucks will be based at fleet depot locations, which is ideal for fleets that drive predictable routes and return to a home-base or depot at the end of the shift. This allows fleet operators to strategically implement and manage charging solutions independently of public charging infrastructure availability. Many fleets that drive less than 100 miles per day can be served by depot charging such as local delivery vans, transit buses, and school buses. Additionally, some tractor applications can also be transitioned to electric with only depot charging, such as day cab tractors travelling less than 200 miles per day regionally and returning to a home-base or long-haul tractors with fixed routes and depot charging at both ends of the route.

Medium- and heavy-duty charging solutions can be tailored to meets fleets’ needs. Often, Level 2 chargers can be used to serve fleet vehicles traveling 100 miles or less per day and returning to depots. Fleet managers can program charging to occur overnight when vehicles are not in use or during off-peak periods to reduce refueling costs. Faster chargers with capacity up to 350 kilowatts (kW) are readily available today.

States that have adopted the ACT rule are working together and with partners to plan for and deploy large regional and national charging and fueling networks to support fleets without access to depot charging and fleets of sleeper cabs that operate longer distances and infrequently return to a single base. For example, states are involved in a number of federally funded studies to identify priority, cost-effective locations for medium- and heavy-duty charging infrastructure investment and to address key barriers for zero-emission freight truck deployment (i.e., Northeast Freight Corridor Charging Plan, East Coast Commercial ZEV Corridor Project, etc.).

What Resources are Available for Fleet Owners Transitioning to ZEVs?

State Incentives - The State of Vermont administers financial incentives that can help fleet owners upgrade their older, more heavily polluting vehicles and achieve significant emissions reductions:

- The Volkswagen Environmental Mitigation Trust provides funding towards the electrification of Class 4-8 medium- and heavy-duty diesel-powered buses and trucks.

- Vermont Diesel Emissions Reduction Financial Assistance can be applied to projects that reduce emissions from diesel highway vehicles and nonroad equipment.

- Electrify Your Fleet is a rebate program developed to accelerate the retirement of internal combustion engine vehicles and electrify the transportation sector.

Federal Tax Credits

- The Federal Commercial Clean Vehicle Tax Credit was developed by the Internal Revenue Service and provides a credit equal to the lesser of 30% of the purchase price, or the incremental cost of the vehicle. The credit amount will not exceed $7,500 for vehicles with a gross vehicle weight rating (GVWR) of less than 14,000 pounds, or $40,000 for vehicles with a GVWR of 14,000 pounds or more.

- An Alternative Fuel Infrastructure Tax Credit, authorized by the Inflation Reduction Act (IRA), to support the installation of electric vehicle supply equipment (EVSE) or EV charging infrastructure up to 30% of the cost, not to exceed $100,000.